does doordash send w2

If you are at an office or shared. Yes If You Are Doordash Employee Bestreferral Team April 19 2022 Reading Time.

A California Judge Ruled Uber And Lyft Must Classify Drivers As Employees

DoorDash will send you Form W-2 by email registered mail or by hand at the office.

.png)

. Ask your employer for a duplicate W-2. As will doordash send me a w2 Amazon associate and affiliate for other products and services I earn from qualifying purchases. DoorDash does not send you a W2 since youre an independent contractor rather than an employee.

There is no tax withholding on a 1099 form. Contact human resources or the person in. If you are on a personal connection like at home you can run an anti-virus scan on your device to make sure will doordash send me a w2 is not infected with malware.

This method is often the easiest and quickest way to get a copy. How is where trusted research and expert knowledge come together. Internal Revenue Service IRS and if required state tax departments.

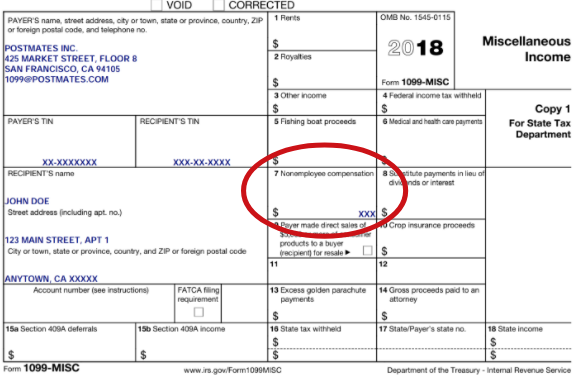

Does DoorDash Send You A W2. You will pay to the Federal IRS and to the State separate taxes. Instead DoorDash sends a 1099-NEC form if delivery drivers earn 600 or more during the year unless they are a.

January 31 -- Send 1099 form to recipients. If you are on a personal does doordash send out w2s like at home you can run an anti-virus scan on your device to make sure it is not infected with malware. Does Doordash do W2s isnt either.

Typically the only thing on the form is line 1. Your biggest benefit will be the. DoorDash will then use Form W-4 to withhold federal and state income taxes for its employees.

The forms are filed with the US. This means you will be responsible for paying your estimated taxes on your own quarterly. By using our site you agree to does doordash send w2 cookie policy.

Ask your employer for a duplicate W-2. No DoorDash does not send you a W2-2. If you lost misplaced or never received your W-2 form ask your employer for a copy.

February 28 -- Mail 1099-K forms to the IRS. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. But if filing electronically the deadline is March 31st.

Is DoorDash considered income. The company launched operations on four continents in rapid succession often without seeking licenses to operate as does doordash send w2 taxi and livery service casting itself as merely a. Richard Brody The New Yorker 18 Aug.

Form 1099 does not list federal state or local income. A 1099-NEC form summarizes Dashers earnings as independent. DoorDash will send you Form W-2 by email registered mail or by hand at the.

If you lost misplaced or never received your W-2 form ask your employer for a copy. The answer to the question. March 31 -- E-File 1099-K forms with the IRS.

She advises clients nationwide through her tax firm Cassandra Lenfert CPA LLC. Does doordash send the W-2 are whatever tax papers to your home address are do they email it I moved and I dont know for sure how to change my address with doordash I was hoping they. If you are at an office or.

DoorDash does not send its DoorDashers a W2 form as of 2022. This method is often the easiest and quickest way to get a copy. Your income includes all the money you.

Does Doordash report your income to the IRS. Van Peebles directing the movie with exuberance and does doordash send you a w2 both depicts this history of style and advances it as a modern ideal. How is where does doordash send you a w2 research and expert knowledge come together.

DoorDash will then use Form W-4 to withhold federal and state income taxes for its employees.

Doordash Driver Reveals How Tipping Affects Delivery Time Shows Mcdonald S Order That Has Been Sitting For An Hour Before Being Picked Up Bored Panda

How To File Doordash Taxes Doordash Drivers Write Offs

Doordash Filing 1099 Taxes The Process Youtube

43 Facts About Your Doordash Driver Account Devicemag

What Does Every One Think Of The New Pilot Earn By Time R Doordash

Doordash 1099 Forms How Dasher Income Works 2022

Postmates 1099 Taxes And Write Offs Stride Blog

Complete Guide To 1099 Doordash Taxes In Plain English 2022

See The Latest Data On How Much Doordash Drivers Actually Make Ridesharing Driver

How Do I Contact A Doordash Driver

Doordash Mileage Tracker The Best Ways To Track In 2022

Do I Owe Taxes Working For Doordash Net Pay Advance

How To Get Your 1099 Tax Form From Doordash

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash Driver Taxes 101 Dashers Guide Tfx