st louis county personal property tax rate

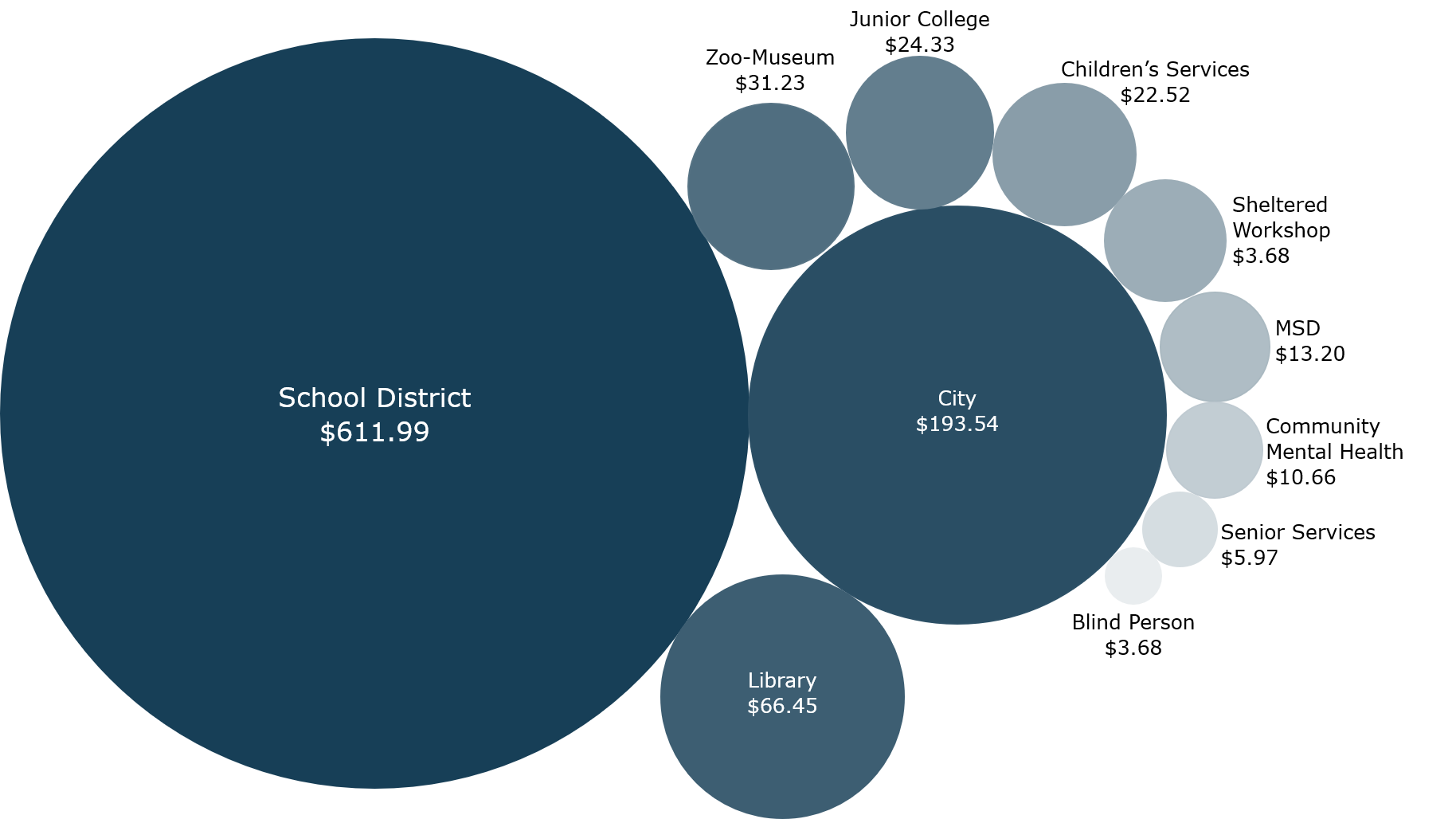

The median property tax also known as real estate tax in St. State Muni Services.

Revenue St Louis County Website

Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

. The median property tax on a. Find Out How Much You Can Save Today. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or.

The median property tax on a 17930000 house is 163163 in Missouri. All Personal Property Tax payments are due by December 31st of each year. How to Calculate Property Taxes.

2022 Individual Personal Property Declarations are in the mail and are due by June 30th 2022. Assessor - Personal Property Assessment and RecordsAssessor - Real. To declare your personal property declare online by April 1st or download the printable forms.

Get free info about property tax appraised values tax exemptions and more. Louis the personal property tax rate is about 828. May 15th - 1st Half Agricultural Property Taxes are due.

If you are a new Missouri resident or this is your first time filing a declaration in St. Asked about tax rates several Velda City officials said they werent aware they were higher than anywhere. November 15th - 2nd Half Manufactured Home Taxes are due.

Payments will first be applied to unpaid fees interest and penalties and then to the unpaid balance of. Louis County MO Property Assessor. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous year s.

Ad Dont Overpay For Your Tax Refund. Pay your personal property taxes online. A valuable alternative data source to the St.

Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802 218 726-2380. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. Locate print and download a copy of your marriage license.

Rates in Missouri vary significantly depending on where you live though. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. St louis county property is based upon data while not make any of.

November 15th - 2nd Half Agricultural Property Taxes are due. Louis County Missouri is 2238 per year for a home worth the median value of 179300. Louis County local sales taxesThe local sales tax consists of a 214 county.

You moved to Missouri from out-of-state. Louis County is 223800 per year based on a median home value of 17930000 and a median. The Assessor together with his team of professional appraisers analysts and managers is required by Missouri law to calculate the market value of real property and.

Place funds in for an inmate in the St. The median property tax on a 17930000 house is 224125 in St. May 15th - 1st Half Real Estate and Personal Property Taxes are due.

For real property the market value is determined as of January 1 of the odd numbered years. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. The median property tax in St.

Louis County collects on average 125 of a propertys assessed fair market value as property tax. Louis County Department of Revenue and by mail. Application to search and view property information.

The states average effective property tax rate is 093 somewhat lower than the national average of 107. In the city of St. Duties of the Assessor.

St Louis County hikes commercial property values in West. For personal property it is determined each January 1. We Have The Highest And Lowest Sales Taxes On All State Tax Filings.

16 Expert Realtors Expertrealtors Twitter First Time Home Buyers Realtors New Construction

2014 St Louis County Unclaimed Property By Stltoday Com Issuu

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Your St Louis County Government St Louis County Website

Housing Choice Voucher Housing Authority Of St Louis County

Collector Of Revenue St Louis County Website

Online Payments And Forms St Louis County Website

Action Plan For Walking And Biking St Louis County Website

2022 Best Places To Buy A House In St Louis Area Niche

Print Tax Receipts St Louis County Website

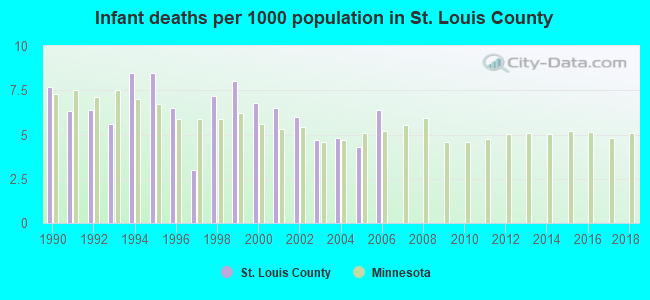

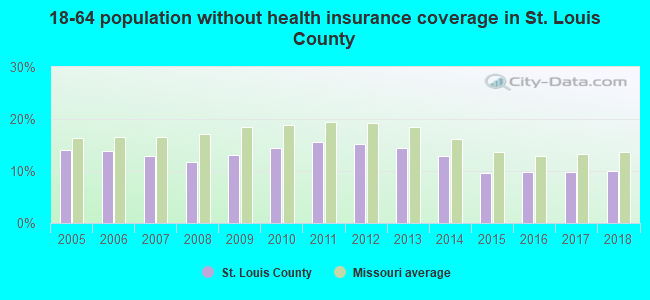

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Collector Of Revenue St Louis County Website

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More